19/05/ · Active trade management is also mandatory when trading this type of strategy. This includes moving stop loss to breakeven and trailing the stop loss to protect profits. Forex Trading Strategies Installation Instructions. Woodie CCI Trend Forex Day Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template 12/03/ · CCI Chandelier Trend Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator (s) and template. The essence of this forex strategy is to transform the accumulated history data and trading signals. CCI Chandelier Trend Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics 34# CCI Floor Forex II - Forex Strategies - Forex Resources - Forex. # Gann, CCI and MACD - Forex Strategies - Forex Resources # Trading 50 cci - Forex Strategies - Forex Resources - Forex # CCI Strategy - Forex Strategies - Forex Resources - Forex # 10 pips a day with CCI and MACD - Forex Strategies - Forex

CCI Chandelier Trend Forex Trading Strategy - blogger.com

Think about it this way: moving averages crosses showing you an uptrend combined with an overbought CCI, tells you which direction to focus on and when.

Once the moving average cross over happens which is confirmed by the CCI indicator, wait for a reversal candlestick pattern and then take the trade. You can use any time frame but consider that amount of noise on lower time frames.

Consider using 15 minute charts and above. I always prefer to trade the major Forex pairs such as EURUSD and GBPUSD. Also consider the more volatile pairs such as GBPJPY or GBPAUD. Do not add any other technical indicators to the mix for this strategy. The only addition will be the use of candlestick patterns of individual candlesticks, cci and tcci forex trading strategy. If those 3 points line up, you have a sell setup happening and to confirm the trading signal, you may want to use a price action entry such as a bearish reversal pattern.

Once you enter the trade, you can use an ATR stop above highs and profits can be a multiple of risk or previous pivots. There will be times that you catch a major turn and the market begins to move with momentum. Ensure you have a proper risk plan in place and when the price is moving strongly in your favor, lock in profits.

Trading Strategy Details You can use any time frame but consider that amount of noise cci and tcci forex trading strategy lower time frames. As mentioned in the title of this post, we are going to use only two trading indicators: CCI commodity channel index using default settings Two exponential moving averages set at 7 and We use a fast and slow exponential moving average so we can see the potential trend change earlier Do not add any other technical indicators to the mix for this strategy.

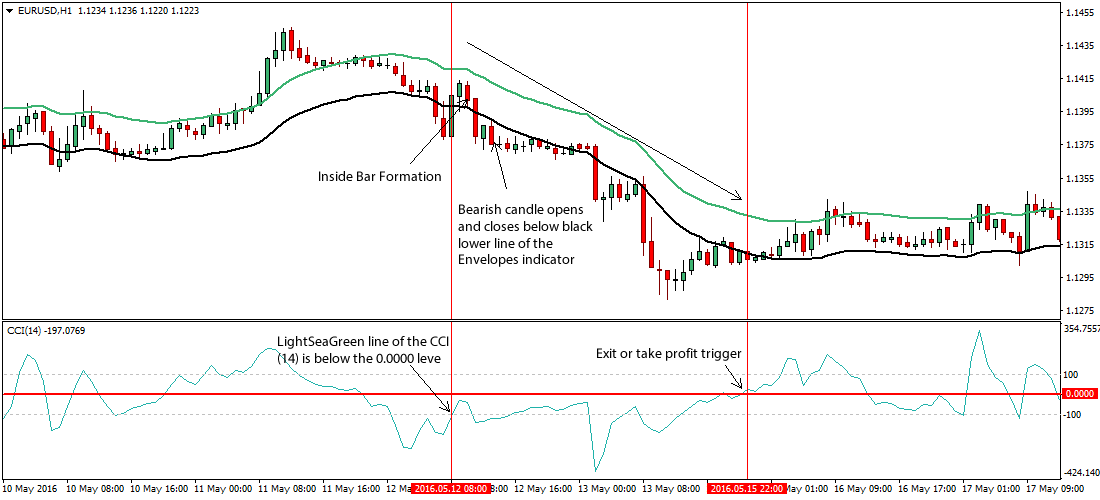

Trading Strategy Rules Please ensure you fully test the rules so you can do them without thinking. Selling rules short position: 7 EMA crosses the 14 EMA to the downside Wait for price to rally back to the moving averages Is the CCI above the level or just crossed below it? If those 3 points line up, cci and tcci forex trading strategy, you have a sell setup happening and to confirm the trading signal, you may want to use a price action entry such as a bearish reversal pattern Once you enter the trade, you can cci and tcci forex trading strategy an ATR stop above highs and profits can be a multiple of risk or previous pivots.

CCI Moving Average Forex Trading Strategy. RELATED Bollinger Band Forex Trading Strategy Using Dynamic Support And Resistance. CCI Moving Average Forex Strategy. Prev Article Next Article.

CCI Moving Average Forex Trading Strategy 〽️

, time: 9:18CCI Moving Average Crossover Trading Strategy

10/05/ · RSI CCI Trend Reversal Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator (s) and template. The essence of this forex strategy is to transform the accumulated history data and trading signals. RSI CCI Trend Reversal Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics 28/06/ · The CCI indicator strategy was really designed to find cyclical trends in the market and to be used as a bearish or bullish filter. The CCI is simply an oscillator indicator that moves the majority of the time between + and Technically, the way to interpret the Commodity Channel indicator is that a positive reading above + is a bullish signal and a start of an uptrend, while a Estimated Reading Time: 9 mins 04/04/ · 34# CCI Floor Forex II - Forex Strategies - Forex Resources - Forex. # Gann, CCI and MACD - Forex Strategies - Forex Resources # Trading 50 cci - Forex Strategies - Forex Resources - Forex # CCI Strategy - Forex Strategies - Forex Resources - Forex # 10 pips a day with CCI and MACD - Forex Strategies - Forex

No comments:

Post a Comment