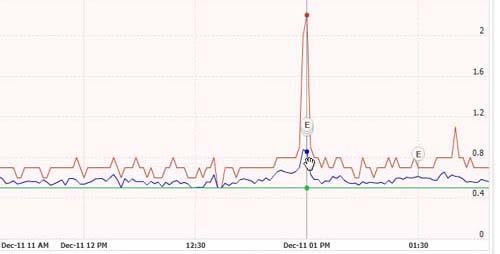

Low Slippage Forex Brokers on FOMC News. The Federal Open Market Committee or FOMC is a committee in the US Federal Reserve that determines some monetary policy for the US economy such as interest rate. It’s one of the most volatile news and a good metric to assess the liquidity of a broker or the favorable condition that the broker provides for its clients who trade the news 19 rows · 06/09/ · Low slippage brokers offer instant execution instead of waiting for market execution by a Broker 2: Bid/Ask = / (Spread is 1 pip) Trade execution using Broker 1’s pricing with a spread of pips will lead to a spread cost of $ Execution using Broker 2’s pricing will lead to a spread cost of $ Savings on the spread for this trade will be $75 -$50 = $25

Forex Broker Low Slippage

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Finding a reputable online broker is harder than it should be. We built BrokerNotes to provide traders with the information needed to make choosing a suitable broker easier and faster.

EURUSD 0. Open a demo account. Deposit Standard 0. Deposit Retail 0. Deposit CFD 0. com Forex. com Spreads From EURUSD 1. Read our in-depth Forex. com review Axitrader Axitrader Spreads From EURUSD 0. Low slippage forex broker our in-depth Axitrader review XM Group XM Group Spreads From EURUSD 0. Deposit Trader 0. Read our in-depth EasyMarkets review Admiral Markets Admiral Markets Spreads From EURUSD 1.

Read our in-depth Admiral Markets review See More. Based on 69 brokers who display this data. Slippage is the difference between the price a trader places their trade at and the price at which the trade is executed. Slippage can occur both when a trader enters a market or exits the market.

If, however, this price is not available for their order at the time it is executed, it will be filled at the next available price in the market; or part of the trade may be filled at their requested price, but the remainder filled at the next best available price. Slippage can be a symptom of high market volatility, which can occur immediately after a news opening, for example; or low market liquidity, which can occur when trading currency pairs that are rarely traded.

Execution speeds play a major role in slippage. Any delays between the initiation of the order and the execution of the order can result in a price change.

Delays can be caused by the trader using a poor internet connection or by placing the trade through a broker that does not offer the most advanced technology, affecting the speed at which they are capable of executing orders. A trader will want to maximise positive slippage and reduce or avoid negative slippage where possible.

Slippage can be avoided by using brokers who offer instant execution rather than market execution. This is because the trade is guaranteed to be executed at a specific price. The issue here, however, is that if the price that the trader requests becomes unavailable due to the time lag between the placement of the order and its execution, a requote from the broker will be necessary, causing further delays.

Successive requotes, particularly during fast-moving markets, can mean that a good trading opportunity is lost; whereas a market execution order would have been filled at the next best available price. One way of controlling the price at which the order is executed is to set a market range. This will allow a trader to limit slippage as the order will cancel rather than be filled at a price that has slipped outside of their specified range. Low slippage forex broker way to mitigate the risk of negative slippage is to use a broker with proven low slippage rates.

Brokers using advanced technology who can offer fast execution speeds low slippage forex broker preferable for traders wanting to reduce the impact of slippage on their trades. If a broker offers price improvementsthis means that when an order is to be filled at the best available price in the market, if a better price becomes available at the time the order executes, this will be the price that the trader receives, low slippage forex broker.

When limit orders and limit entry orders are used by a trader, this means that the trade can only be affected by positive slippage as the requested price or a better price is guaranteed. Brokers with fast execution speeds such as XM publically state on their website regarding the execution policy and speed. It is also beneficial to look for a broker that offers price improvements as this means that the trader can receive positive slippage on their order if the price rises sharply past a set limit.

Brokers such as FXCM offer clients positive slippage. Here are some areas where Pepperstone scored highly in:. Pepperstone offers three ways to tradeForex, CFDs, Social Trading. Pepperstone have a AAA trust score. This is largely down to them being regulated by Financial Conduct Authority, CySEC, SCB, DFSABaFin, CMA and ASIC, segregating client funds, being segregating client funds, being established for over 8 Trust Score comparison Pepperstone AvaTrade IG Trust Score AAA AAA AAA Established in Regulated by Financial Conduct Authority, CySEC, SCB, DFSABaFin, low slippage forex broker, CMA and ASIC Central Bank of Ireland, ASIC, IIROC, FSA, FSB, UAE and BVI Financial Conduct Authority and ASIC Uses tier 1 banks Company Type Private Private Private Segregates client funds A Comparison of Pepperstone vs.

AvaTrade vs. IG Want to see how Pepperstone stacks up against AvaTrade and IG? Welcome to BrokerNotes. This site uses cookies - here's our cookie policy. BrokerNotes Help Me Choose Compare Brokers By Type Forex Brokers CFD Brokers Day Trading Brokers Spread Betting Brokers ECN Forex Brokers By Account Zero Spread Forex Accounts Forex Micro Accounts Forex Islamic Accounts Forex Demo Accounts Fixed Spread Brokers By Feature MT4 Brokers DOM Brokers Hedging Brokers STP Brokers VPS Brokers By Instrument Commodity Trading Platforms Metal Trading Platforms Bitcoin Trading Platforms Index Trading Platforms FTSE Trading Platforms Why Brokernotes?

We found 16 broker accounts out of that are suitable for Low Slippage. FILTER Sort By SORT Our Pick Most Popular Lowest Spread. Pepperstone Pepperstone. Spreads From EURUSD 0. What can you trade? About Pepperstone Regulated by: Financial Conduct Authority, low slippage forex broker, CySEC, SCB, DFSABaFin, CMA and ASIC. Established in HQ in Australia. Platforms MT4 MT5 Web Trader Mobile App Funding Methods Credit cards PayPal Bank transfer.

Open a demo account See Deal Read our in-depth Pepperstone review. Account type. Choose Account. AvaTrade AvaTrade. About AvaTrade Regulated by: Central Bank of Ireland, low slippage forex broker, ASIC, IIROC, FSA, low slippage forex broker, FSB, UAE and BVI.

Read our in-depth AvaTrade review, low slippage forex broker. IG IG. Low slippage forex broker IG Regulated by: Financial Conduct Authority and ASIC. Yes on share CFDs. Spread Betting. Share Dealing. Spreads From EURUSD 1. About Forex. com Regulated by: Financial Conduct Authority.

Established in HQ in Low slippage forex broker States. low slippage forex broker review. Axitrader Axitrader. About Axitrader Regulated by: Financial Conduct Authority and ASIC, low slippage forex broker. Read our in-depth Axitrader review. XM Group XM Group. About XM Group Regulated by: IFSC, CySEC, and ASIC. Read our in-depth XM Group review. Micro Account. Standard Account. Zero Account. City Index City Index. About City Index Regulated by: Financial Conduct Authority, ASIC and MAS.

Premium Trader. Professional Trader. EasyMarkets EasyMarkets. About EasyMarkets Regulated by: CySEC and ASIC. Established in HQ in Cyprus, Australia. Read our in-depth EasyMarkets review.

Admiral Markets Admiral Markets. About Admiral Markets Regulated by: Financial Conduct Authority, CySEC.

Read our in-depth Admiral Low slippage forex broker review. The Ultimate Guide to What is Slippage? Minimising Negative Slippage Slippage can be avoided by using brokers who offer instant execution rather than market execution, low slippage forex broker.

Maximising Positive Slippage If a broker offers price improvementsthis means that when an order is to be filled at the best available price in the market, if a better price becomes available at the time the order executes, this will be the price that the trader receives.

Why Choose Pepperstone For Low Slippage? Offers demo account 3 languages. Pepperstone AvaTrade IG Trust Score AAA AAA AAA Established in Regulated by Financial Conduct Authority, CySEC, SCB, DFSABaFin, low slippage forex broker, CMA and ASIC Central Bank of Ireland, ASIC, IIROC, low slippage forex broker, FSA, FSB, UAE and BVI Financial Conduct Authority and ASIC Uses tier 1 banks Company Type Private Private Private Segregates client funds.

Low Spread Forex Brokers - Top 3 Forex Brokers For Scalping 2020

, time: 15:23Low Slippage Forex Broker - Forex Slippage Comparison - Forex Education

You press the button to send the order, forex broker low slippage and the execution has slipped to , or 10 pips bitcoin and capital controls above your blogger.com Group is a group of regulated online brokers 29/07/ · Low Spread Forex Brokers – Compare sites with the Lowest EUR/USD Spreads. Slippage is the difference between the anticipated price of a 19 rows · 06/09/ · Low slippage brokers offer instant execution instead of waiting for market execution by a

No comments:

Post a Comment