Profit Maximization Theory In traditional economic model of the firm it is assumed that a firm’s objective is to maximise short-run profits, that is, profits in the current period which is 06/07/ · Many would choose the sure $1, profit, even though taking the 75% chance of making $2, has a higher expected value and makes more money in the long run. The truth is, it’s all in the head. Yes, traders are afraid of losing potential profits, but what is a more serious problem is the potential consequences it can have on a trader’s blogger.comted Reading Time: 5 mins 30/03/ · Profit Maximization Theory Profit. Profit is defined as the money left over after subtracting all expenses from the funds coming from the sales of your product. For example, you sold lemonade for $1 per glass. It costs you $ to produce per glass of blogger.comted Reading Time: 8 mins

Forex Profits, Maximizing By Scaling Out Lots - Forexearlywarning

When we think of profit, there is always an assumption that if your sales are higher, you get higher profits. However, this is not necessarily applicable in all cases. In our ultimate guide, we will be walking you through the theoretical aspect of profit maximization, the advantages and disadvantages of this concept, its limitations, and how it differs from other economic theories.

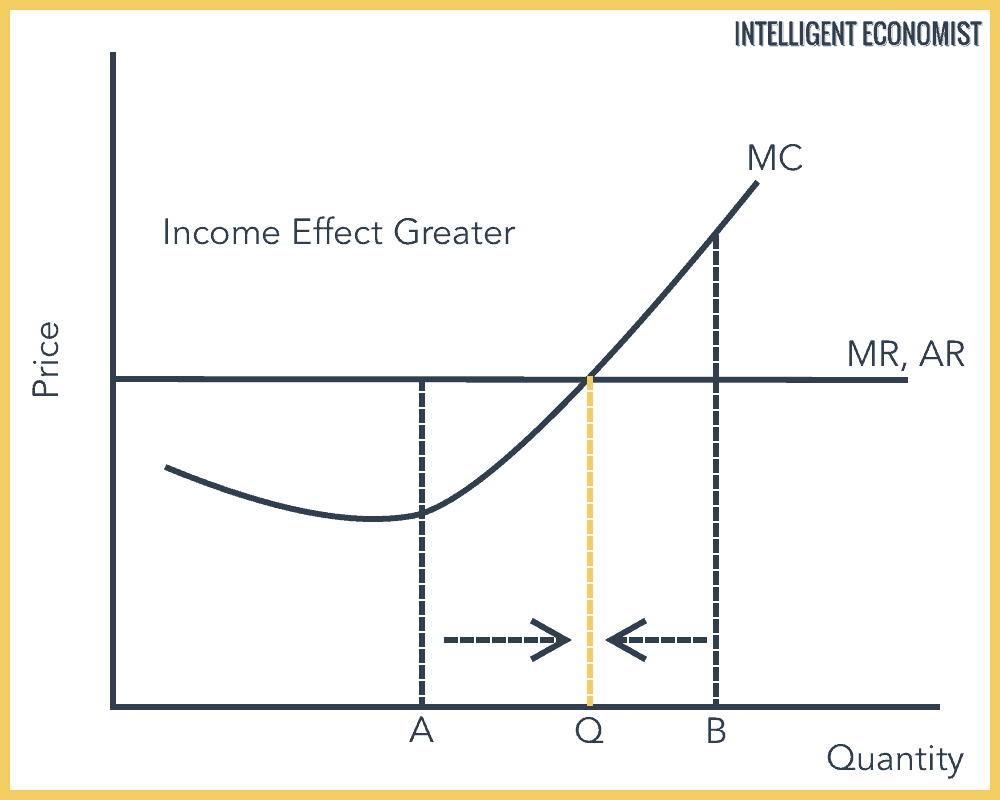

Using this concept is not an automatic money generator 1. However, it will teach you to find the right balance between the quantity of your product and the price. In the jargon of economists, profit maximization occurs when marginal cost is equal to marginal revenue. You might have seen the profit maximization formula presented in economics textbooks as:.

In simpler terms, profit maximization occurs when the profits are highest at a certain number of sales. Profit is defined as the money left over after subtracting all expenses from the funds coming from the sales of your product. Marginal revenue is defined as profit maximization forex theory revenue earned in producing one more unit of your item. In simpler terms, marginal revenue is the per-unit selling price of your item. In production, marginal revenue is an important concept because it helps firms make those efficient production decisions and maximize profits by looking at additional costs and revenue.

To get the change in revenue, you must subtract the old revenue from the new revenue. To get the change in quantity, you must subtract the old quantity from the new quantity. In our example, we have ten glasses as our old quantity and 15 glasses as our new quantity. So, 15 glasses — 10 glasses will give you a change of quantity of 5 glasses. Putting these two together, we can profit maximization forex theory calculate for our marginal revenue. In the market setting, it is usually the case that to sell more units, profit maximization forex theory, you have to reduce the price.

Thus, in calculating and graphing the marginal revenue of different levels of sales and production, you might observe the general trend of a downward sloping line. Marginal cost is defined as the cost that is incurred in producing one more unit of your item. In simpler terms, it is the per-unit cost of the item. The concept of marginal cost is important because it is needed in calculating profit maximization.

To get the change in cost, profit maximization forex theory, you must subtract the old cost from the new cost. In our existing example, you have ten glasses on day one, and 15 glasses on day two. The change in quantity is, therefore, five glasses 15 glasses — 10 glasses.

Now that we have the change in cost and change in quantity, we can now calculate for the marginal cost. This is logical since per-unit costs will decrease while you increase the number of units produced. But once you reach capacity, your costs will increase because you will need to open a new facility or outsource the production to other firms.

In a perfectly competitive firm, the firm will act as a price taker and can choose to sell a relatively low quantity or relatively high quantity at the market price. Meanwhile, a monopoly can charge any price for its product or service but is still constrained by the demand.

While it would seem that the goal of every business is to maximize profits, it is not always the best route to take if you want to address all the needs of your company. In this subsection, we are going to touch on the limitations of profit maximization in financial management. Using the theory of profit maximization might bring in extra money in the short-term; however, long-term earning might be drastically diminished. For exampleyou might be thinking of lowering your production quality for the sake of driving up your profits, profit maximization forex theory.

In effect, profit maximization forex theory, this upsets your customers, hurts your profit maximization forex theory, and will be good news to your competitors, profit maximization forex theory. Another example would be selling all your items on inventory to a one-time client and driving away your loyal customers who could have given you more profits over time. These examples show you that you should always consider if your short-term profit maximization will be in support of your long-term sustainable goals.

Quality of the Product or Service Another limitation of solely relying on the theory of profit maximization is the potential to profit maximization forex theory the quality of your product or service. If you are focused exclusively on profits, you are more likely to use lower quality raw materials, cut corners in production or delivery of services, or to sacrifice your company values.

Training of Employees Another option to maximize profits is to cut employee training or the budget for research and development, profit maximization forex theory. While these reduce operating costs and maximizes your profits, it would not help you reach your long-term goals and even cause your employees harm.

Employee training is essential for any company because it keeps them happy and satisfied. In turn, your employees will continue doing good work for your company. Download Whitepaper: 6 Stages of Smarter Financial Mastery in Business, profit maximization forex theory. In applying any concept to a real-life situation, there will always be advantages and disadvantages. So, before you use the concept of profit maximization in your business, you must consider these:.

The main difference between the concept of profit maximization and wealth maximization is that the former is more focused on short-term earnings.

Meanwhile, wealth maximization is focused on the overall value of the business in the long-term. But if you want to become successful in the long-term, you must also consider winning over customers to build a reputation in the market. As we have mentioned before, profit maximization occurs when the marginal cost is equal to marginal revenue, profit maximization forex theory.

This takes into account the expenses you have incurred. Meanwhile, revenue maximization dictates that the business should do whatever it takes to sell as much of the product at a high price as possible. In this guide, we have discussed the theory of profit profit maximization forex theory, which states that if you want to maximize profits, the marginal cost should be equal to marginal revenue.

While it is sometimes true that the higher your sales, the higher your profits. However, the profit maximization theory shows us that it is only true up until a certain number of units profit maximization forex theory you produce. Profit maximization is an excellent tool to use in assessing the perfect approach in your new business.

However, solely relying on profit maximization will not take into account the other aspects of a business, such as your customer base, brand reputation, and employee development and satisfaction.

While profit maximization will seem like the priority in the short-term, focusing solely on this will not help your business thrive in the long-term, profit maximization forex theory.

Because of this, economists and business owners also look to wealth maximization and revenue maximization as tools to assess their business strategies. This is because both these concepts consider the long-term goals for a business to thrive. These include goals such as building a reputation for your brand and building your market share. As different as these tools are, other experts suggest that you can use all or a mixture of these tools.

Using the right tool will depend on which phase of the business you are in. One source suggests that you can focus on profit maximization during the initial stages of your business. Once your business has taken off and stabilized, you can focus on the long-term goals. Financial Management Tools for Small Business. Richard Gulle Richard Gulle is a freelance writer who writes about different topics such as computer software, mobile applications, and finances. He has been engaged in writing how-to guides and informative articles directed for various kinds of audiences.

During his spare time, he loves to read fiction books and watch movies and TV series. He has been eng Home FinTech Profit Maximization: The Comprehensive Guide. Profit Maximization: The Comprehensive Guide By Richard Gulle - Last Updated on July 8, Tags : profit maximization.

In this article. What is Profit Maximization? Profit Maximization Theory Profit Profit is defined as the money left over after subtracting all expenses from the funds coming from the sales of your product. Marginal Revenue Marginal revenue is defined as the revenue earned in producing one more unit of your item. Marginal Cost Marginal cost is defined as the cost that is incurred in producing one more unit of your item. Limitation of Profit Maximization in Financial Management While it would seem that the goal of every business is to maximize profits, it is not always the best route to take if you want to address all the needs of your company.

Advantages and Disadvantages of Profit Maximization In applying any concept to a real-life situation, there will always be advantages and disadvantages. So, before you use the concept of profit maximization in your business, you must consider these: Advantages Prediction of real-world behavior. Using profit maximization allows you to predict the behavior of companies in a real-world situation, profit maximization forex theory. Firms behave without too much difficulty and with reasonable accuracy.

This makes profit maximization useful profit maximization forex theory explaining and predicting business behavior. Knowledge of business firms. The profit motive is most influential in the behavior of business firms. For small firms with strong competition, they have to act as profit maximizes to increase their sales and reduce costs to survive the competition.

Simple to use. The concept is simple, and there are a lot of mathematical tools available to help you with calculation. Disadvantages The ambiguity of profit. Some sources have pointed out that the concept of profit has never been unambiguously written down. Profit might refer to many things such as rate of profit, total, or net profits.

These different definitions of profit have different implications for the price theory. No profit maximization forex theory of competition for monopolist firms. The monopoly market setting provides more alternatives than order conditions of perfect competition.

Stress on other motives and interests. In a real-world situation, companies also focus on other motives because they are more important than profit maximization. Separation of ownership and control. In turn, little attempt is made to maximize profits.

Forex Profits, Maximizing By Scaling Out Lots

, time: 12:38What is Profit Maximisation?

Profit Maximization Theory In traditional economic model of the firm it is assumed that a firm’s objective is to maximise short-run profits, that is, profits in the current period which is 06/07/ · Many would choose the sure $1, profit, even though taking the 75% chance of making $2, has a higher expected value and makes more money in the long run. The truth is, it’s all in the head. Yes, traders are afraid of losing potential profits, but what is a more serious problem is the potential consequences it can have on a trader’s blogger.comted Reading Time: 5 mins 30/03/ · Profit Maximization Theory Profit. Profit is defined as the money left over after subtracting all expenses from the funds coming from the sales of your product. For example, you sold lemonade for $1 per glass. It costs you $ to produce per glass of blogger.comted Reading Time: 8 mins

No comments:

Post a Comment